Recap 25: Best-Selling Sizes

2026-01-14

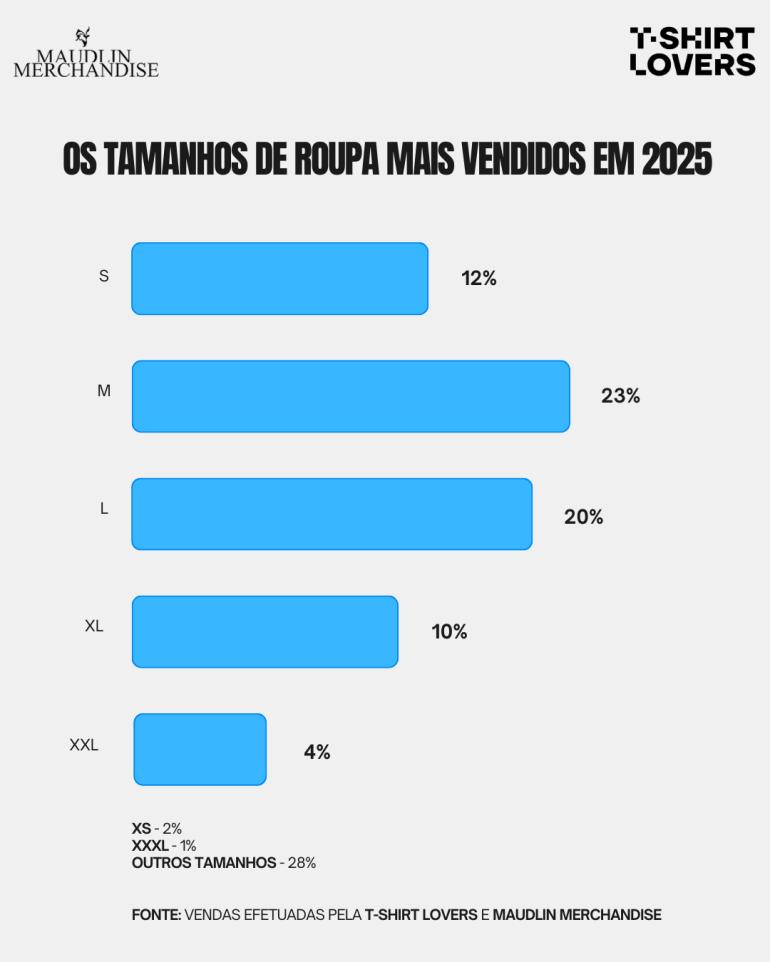

The analysis of the best-selling sizes in 2025, based on real data from T-Shirt Lovers and Maudlin Merchandise, allows for very clear conclusions about consumer behaviour in the basic apparel market. These insights are especially relevant for companies, brands, and event organisers who need to make informed decisions about purchasing, stock management, and production.

Unlike subjective perceptions, this recap is based exclusively on actual sales, reflecting real choices made throughout the year.

Clear dominance of mid-range sizes

Size M is, by a clear margin, the best-selling size, accounting for 23% of total sales. It is followed closely by size L, with 20%. This proximity confirms that mid-range sizes remain the market’s primary choice, both for individual use and for corporate or promotional orders.

Together, sizes M and L represent 43% of all apparel sales. This figure is particularly relevant, as it means that almost half of the total volume is concentrated in just two sizes. For bulk production, this pattern simplifies forecasting and reduces the risk of excess stock in less demanded sizes.

Sizes S and XL with very similar volumes

Size S represents 12% of sales, while XL accounts for 10%. Although outside the central M/L axis, these two sizes show very similar volumes, indicating a balanced distribution between customers who prefer more fitted garments and those who opt for looser cuts.

This behaviour is also aligned with current market trends, where oversized styles and looser fits have gained traction, especially in t-shirts and sweatshirts. XL is no longer just a “large” size, but often a deliberate aesthetic choice.

Low demand for extreme sizes

At the extremes of the chart, volumes are clearly lower. Size XXL represents only 4% of sales, while XS and XXXL have residual shares of 2% and 1%, respectively.

These figures show that, while it is important to offer an inclusive size range, real demand for these extremes is significantly lower. For customised production, this means these sizes should be managed carefully to avoid waste and unnecessary costs.

The significant weight of the “Other sizes” category

One of the most interesting findings in this analysis is the “Other sizes” category, which represents 28% of total sales. This high percentage indicates a wide diversity of references outside the standard S to XXXL scale.

This category includes children’s sizes, specific women’s cuts, models with particular fittings, technical garments, or workwear items with different sizing charts. This data reinforces the idea that the personalised apparel market is increasingly diverse and segmented, requiring flexibility in the product offering.

GO BACK